Brand and Business Leverage Through Book Publishing

Brand and Business Building?

When you think of the word brand, what comes to mind, and where does it fit in your business-building strategy?

In layperson’s terms, a brand is about the widely held perception by which a business becomes known. It is usually seen in the slogan or tag accompanying a business name.

A typical example is Nike, who is known for the slogan – 'Just do it!' Nike is associated with decisiveness and action without excuse. Another is Coca-Cola, which is supposedly ‘The real thing.’

Now, whether you believe that or not is another thing, these slogans are used to frame the perception a company wishes you to hold when thinking about them. It is all too easy to come up with desirable, flashy concepts that appeal to the minds of onlookers and retail customers, and it's quite another thing to live by it.

Brand Building through Book Publishing

Similarly, in the book publishing world, it is relatively easy to rank as a bestseller once you understand the criteria and maths involved. It is possible to manipulate the statistics in your favour.

For example, if an author buys 5000 of their own books from Amazon, well, that equates to 5000 sales and potential bestseller status. There are many who have done that for the status and to frame the perception of their onlookers. A best seller speaks to sales but not necessarily impact.

Image Source: Amazon

This type of practice can end up as a gimmick that will eventually come back to bite if your reason to do it is purely to sell rather than impact your audience.

With this all-important issue, book publishing can plug a much-needed gap, and when done properly, you can have the best of both worlds. After all, becoming a best seller means greater exposure, visibility, and publicity, which is valuable, especially when its roots are in the objective of impacting lives with applied knowledge that works.

With book publishing, you have the opportunity to help people view you as an expert in your field. So, let’s loop back and review why you may wish to publish a book as part of building your brand and, therefore, your business.

Why Publish a Book?

A book is a vehicle for organising, articulating, and publishing your message of expertise so that many can be helped where they struggle with the problems your expertise can solve. It imparts insight into the nature of those problems and provides clear steps by way of the solution that can be applied.

Some of the most influential books are those that share the author’s journey with the struggles they have now found solutions to. Why? Because experience is more powerful than theory alone. In terms of the customer journey, it helps with that part of the journey where they get to know, like, and trust you.

When you take that knowledge embedded within the personal journey of your struggles and discoveries and combine it with real-world case studies and examples of successful application, it helps to break the isolation of their journey reader further. It enables them to know that there is a possible solution.

Your book is the articulation of your solution, and it showcases your expertise and ability to solve problems your audience may be seeking. It amplifies your authority and credibility and allows your reader to test-drive your solution.

Many may seek your skilled input beyond a DIY application if your insights speak to the gaps in their application, and they are able to start to change the trajectory of their life and business.

Image Source: Scribe Media

Stepping out into Authorship

Unpacking your expertise

A great place to start is to unpack your knowledge and expertise onto paper in no particular order. This is often referred to as a brain dump. From that place, you can then start to organise your notes under categories or themes. If you try to do both at once, it may slow the process down. For a bit of fun, why not use an egg timer and do it against the clock to sharpen focus?

If you have got this far, you are doing well, but it is a wasted effort if you do not go on to complete this process. Research shows that approximately only 3% of people go on to complete the writing of their book.

There could be many reasons, including perfectionism, writer’s block, uncertainty about the process, and low confidence. Some people express themselves better in writing than verbally; for others, it is the other way around. Maybe, for some, the ‘imposter syndrome’ sets in because they perceive it to be too prestigious.

Things that could help are being interviewed by someone or recording your expressions in order to retain your voice and style of expression. Alternatively, you could consider getting someone to write your book once they have grasped the core points of your message. This is something that footballers and managers do. They hire ghostwriters to help them get their books out there. There are many ghostwriters, whether for fiction or non-fiction.

You could go to a freelance site like fiverr. On the other hand, if you are a changemaker, you might prefer a more personalized approach compared to a traditional commercial approach to ghostwriting, so that would require more in-depth research to find someone who resonates with your criteria and will assist you throughout the process to break the overwhelm.

Authorship via Books

You can learn how to write a book by picking up the books of those who have inspired you and observing their literary style and organisation of expertise. Here is an example of one regarding leadership.

Authorship via Book Fayres

If you prefer the offline world where you can meet people face to face, you should visit a book fayre. They will cover everything from writing to publishing and promoting. Many agents and dealers will be advertising their publishing services.

Authorship via Teaching

The process of publishing a book can be daunting for many, so it may be unsurprising that only about 20% go on to publish their book. After all, beyond the writing and publishing of your book, there is the promotion to think about as well.

You might wish to enroll in an online masterclass in order to become an author, and there are many out there from those who want to be the next Malcolm Gladwell or otherwise.

Authorship via Online Summits

Suppose you want to garner the wisdom of people across the globe. In that case, online summits are a great idea because they focus on sharing the knowledge and experiences of many authors, which will bring many different facets to your authorship journey.

Some are paid in that either you pay to attend, or if you take part as one of the speakers, there is an expectation to cross-promote the event and the other speakers with a financial reward. In other words, the speaker becomes an affiliate of the summit.

There are others that are not so. These types of summits draw those who genuinely want to share and simply encourage you to share with no expectation of reward, which I prefer these days and have contributed to.

Roger Bannister Effect

The great thing about exposing yourself to people who have been there and done it is that when you see so many authors who have gone before you who have just done it, it helps to raise the belief that it can be done and that you can do it. I often refer to this as the Roger Bannister Effect.

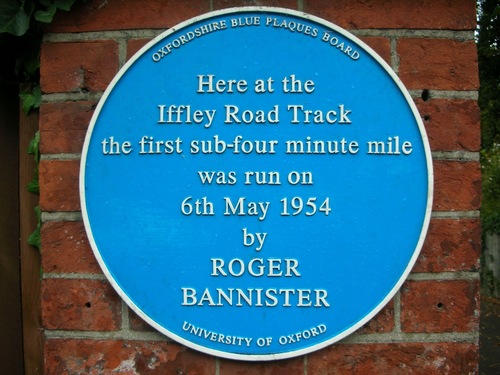

Image source: Wikimedia

Roger Bannister broke the 4-minute mile, and when he did so, many went on to break it because, in his accomplishment, his demonstration broke the limiting belief that it was impossible. Nelson Mandela is often quoted as saying, “It always seems impossible until it's done.”

Publishing

There are a few options depending on how much control you want over the editing, marketing, and royalties. You might decide to self-publish and get your book on Kindle and Amazon.

You can also get help publishing your book on Amazon and Kindle through freelance sites, which is an obvious starting place for many who are starting out. If you decide to use Amazon as a start, consider how you will capture the contact details of prospective readers first so you can grow your audience, not just your book sales.

You might wish to hire a publisher who will offer in-house publishing and promotional services. You might even consider a major publisher if you have an already established audience, but be prepared for less control and royalties.

I recall writing my first book publishing project, and I will share this experience on my personal blog at some point, as there were many things that went well and things that did not, but it was a valuable experience, one that I can build on.

The key thing is to get started. There is no substitute for experience; you can always iterate and improve as you go along. So now it's your turn.

Become an author of your expertise and turn the impossible into possible so that you can make a difference and impact the lives of those seeking what you have to offer.

David https://markethive.com/david-ogden

.jpg)