The Biggest Ponzi Of All Time

Impacting All Of Humanity

Many of us have been victims of crypto scams, and yes, they are out there in droves. We’ve all heard the comment, “Bitcoin is a Ponzi scheme.” But who is saying this about the cryptocurrency that has earned the right to be the store of value for all cryptos and labeled “Digital Gold”?

The statement is a falsehood that’s knowingly propagated by bankers and unknowingly spread by ignorant, no coiners. It’s being used as a ruse to deflect from one of the biggest and longest-running Ponzi schemes of all time. A system so fundamentally flawed that it’s flabbergasting to see that it exists to this day.

I am, of course, talking about the fiat money system—a proverbial house of cards, where billions of sheeple seek cover. With the assistance and research conducted by Coin Bureau, we look at the matrix equivalent of the monetary red pill, and by the end of this article, you will never be able to look at that money in your wallet in the same way again.

The Inception Of Paper Money

Let’s start with a bit of a refresher course on Fiat money. Most people associate the cash in their pockets and bank accounts as Fiat money. But in reality, the concept is much broader than that.

Money is a concept that has been around for hundreds of years. Paper money first started being issued in 1697 by the Bank of England. US dollar started hitting the scene in 1792 per the coinage act. Before this, coins made from gold and silver were used as the monetary medium in society.

However, with the introduction of paper money, these Banks could issue bills that were easier to denominate, store and spend. They were a lot easier to be used as money. However, you always had one key thing with this centrally issued money; some reserves backed it. This was termed the convertibility of money.

You could theoretically exchange those dollars in your hand for a certain quantity of some precious metal. In most cases, this was gold. This is where the term the gold standard originated. It created a certain level of confidence among those that held it that there was particular value behind it. The money in your hands and that which was in your bank had intrinsic value. Not only that, but strict adherence to the gold standard would limit the potential for damaging inflation.

Of course, the gold standard’s most significant advantages can be seen by some as disadvantages. This is because the money supply in the system is naturally limited by the amount of gold kept in reserves. Strict adherence to the standard can even lead to deflation which is also damaging to the economy.

Owning Gold Deemed Illegal

The convertibility of gold was a pressing issue for FDR during the Great Depression as it limited the money supply. He issued an executive order which made owning gold illegal and required everyone to convert it into US dollars.

He did this to set a government price for that gold that was quite inflated. This would then allow the Federal Reserve to inflate its balance sheet by over 70%. So yes, the gold standard was not ideal for these governments, but at least it kept them in check. It marked a certain degree of confidence in the value of money and, when applied correctly, could prevent hyperinflation.

The Bretton Woods Agreement

So confident were the countries in the virtues of the gold standard that in 1944, forty-four countries signed on to what was called the Bretton Woods Agreement. Within the Bretton Woods system, all national currencies were valued in relation to the US dollar. This, therefore, made the US dollar the dominant reserve currency. The dollar, in turn, was convertible to gold at a fixed rate of $35 per ounce. So you can think of it as a quasi-gold standard still backed by gold, but indirectly.

The Bretton Woods system had a pretty decent run until 1971. It was then that Richard Nixon committed his first impeachable offense. Nixon's termination of the convertibility of USD into gold should have sunk him before Watergate. This is because Nixon set the wheels in motion for the current Fiat money system that we know today, a glorified confidence game backed by nothing. So what exactly happened?

Fiat, No Gold, No Intrinsic Value

In August of 1971, Nixon said that the US would “suspend temporarily the convertibility of the dollar into gold or other reserve assets, except in amounts and conditions determined to be in the interest of monetary stability and in the best interests of the United States.”

Well, it turns out that that temporary suspension became permanent, and it ended any sort of Illusion that the US dollar and, by extension, 43 other currencies were backed by gold. In fact, the US dollar was backed by nothing.

From then on, money only had value because the Federal Reserve and the US government said it did. It was a piece of paper that people agreed between themselves had a specific value. It's also no coincidence that after we saw this abandonment of a form of monetary tether, we had an inflation of the monetary base. This then led to the periods of high inflation in the late 1970s and early ‘80s.

Fiat Money Doesn’t Exist

So now we know that Fiat money does not have any intrinsic value and that it's all one big confidence game where we the people have to believe the government's promises. But the really shocking thing about this, though, is that most of the money in circulation does not actually exist.

So what do I mean by that? To understand it better, we have to look at how money makes its way through the system. The primary method of which is Fractional Reserve Banking. This calls for a bit of an overview.

What if I told you that the money you think you have in the bank is not actually there. You see, this money has been lent out to many of the bank's other customers. And banks are allowed to do this because of the fractional reserve system.

You give your money to the bank for safekeeping, and they turn around and use it for their own purposes. They only have to keep a certain amount of deposits related to the loans they’ve issued out. This is termed rehypothecation, and it's not only restricted to banks. It's also used by other Financial entities, such as Brokers, etc.

In this situation, the banks are hoping that only a tiny proportion of their users will withdraw. Hence, they keep a small buffer of deposits in this case. Now, I know what you're thinking. This is incredibly risky. What happens if all the depositors come and request their money all at once? Well, then you get what is termed a bank run. And it is precisely as the name would suggest.

When all people rush to withdraw their funds at once, the bank has a liquidity crunch, and they cannot pay out the depositors. Rumors mainly cause bank runs. If people hear that a particular bank is facing a liquidity crunch, they will rush to withdraw their funds which, of course, feeds the rumor. It's pretty scary. A bank can have no underlying issues, but the mere talk that it’s short on funds could cause everyone to withdraw simultaneously, making it a self-fulfilling prophecy.

All Banks Are Susceptible To Bank Runs

What is disturbing about bank runs is that every single bank is susceptible. It's not only those short of liquidity but also those in a relatively strong position. All you need is one picture of a line outside a bank, and it drives the panic. Bank runs were typical during the Great Depression. People heard about one bank facing a run, so they naturally tried to rush to their bank to withdraw their funds, thereby leading to panic further.

Here's a fun fact; The bank runs prompted the formation of the Federal Deposit Insurance Corporation or FDIC.

The federal government believed that if they guaranteed a certain amount of deposits, people would feel comfortable. While this brought stability for run-of-the-mill bank runs, you need to understand that FDIC only ensures up to 250,000 dollars in deposits. Those with balances above are still at risk of a loss.

Many may argue that 2008 was a high-tech version of a bank-run. Financial institutions started withdrawing their deposits at highly leveraged investment banks, which led to a massive liquidity crunch. Furthermore, bank runs still take place quite regularly in other countries around the world.

In 2008 the UK had a retail bank run on Northern Rock. Then there was the Eurozone crisis in the 2010s where bank runs plagued countries like Greece and Cyprus, so much so that the government had to limit the number of Euros that people could withdraw from the ATMs – only 60 Euros per day.

Imagine that; you've placed your life savings in a bank account, and now you're looking to withdraw it, and the bank limits you to a measly 60 Euros a day. However, it's not like the government had a choice, as there was no more liquidity in the system. The European Central Bank decided not to further increase its Emergency Liquidity Assistance for Greek banks; they had to introduce capital control.

The Greek government was forced to immediately close Greek banks for almost 20 days, implementing controls on bank transfers from Greek banks to foreign banks and limits on cash withdrawals, to avoid an uncontrolled bank run and a complete collapse of the Greek banking system. All of this happened because the banks were built on a precarious system of fractional reserves. That’s one aspect, but it’s not the worst thing about fractional reserve banking.

Fractional Reserve Banking

Fractional reserve banking plays a fundamental role in the multiplication of money. This reserve ratio is not determined by the Banks but by the Fed or equivalent Central Bank. It's the minimum amount of deposits they must hold in liquid securities to meet their obligations. This stock of money kept in near-term deposits is generally referred to as the M1 money supply.

But here is where things get interesting. The M1 money supply is the money that includes coins and notes in circulation, along with other money equivalents that can easily be converted. Because the banks are allowed to lend out money to their customers, they can increase the broader money supply to many multiples of the actual money that's in the system.

So, for example, if the reserve requirement is 5%, only 5% of the bank balance sheet should be held in this liquid money. The other 95% can be loaned out, so that means that the bank can lend out 20 times the amount of money that's kept on its balance sheet.

This is called the multiplier effect of money and means that the broader money in the economy can be many multiples of the money that actually exists in the bank. You can think of it as a leveraged trade in a crypto position. The one difference is if things go belly up, you won't be the only one getting absolutely rekt.

This broader definition of money is termed the M2 and M3 money supply. And to give you an idea of just how much this inflates the outstanding money supply, the image below shows the M2 and M3 money supply compared to M1. The first bar shown (M1) is the only one that is actual tangible money. This was back in 2001.

The graph below illustrates the evolution of the M1 and M2 money supply over the past few years.

It would seem that the person who drew up the graph ascertained the fact that M2 inflation mainly benefits Wall Street. Notice the spike illustrated at the top in the red box? That’s the Covid pandemic and it had a massive impact on the broader money supply.

So why did this happen? Was it because the FED printed a lot more money? Well, yes, that is the slight uptick we see in the M1 money supply indicated at the bottom. However, this massive explosion of the M2 money supply shown above is a combination of another Factor.

You see, central banks can use the reserve requirement to impact the broader money supply. It's one of the three tools at their disposal—the other two being the federal funds rate and open market operations: bond purchases, etc.

All the Fed needs to do to increase that money supply with the reserve ratio is lower it. This means that the money multiplier is higher the more it is injected into the economy and vice versa to contract the money supply.

Pre-pandemic, these reserve requirements varied according to the number of net transaction accounts at the bank in question. The reserve ratio itself ranged from 3% to 10% for many years. This made sure that banks had reserves that were broadly in line with their activity. Those viewed as riskier had to hold more funds and were more restricted in effectively creating money.

However, along came the global pandemic, and that reserve ratio requirement went out of the window. On the 26th of March in 2020, the Fed dropped the reserve ratio to 0% for all banks. In other words, they eliminated any need for reserves at all.

Now banks are not required to keep reserves to meet withdrawal requests. They can effectively loan out as much money as they want into the economy, thereby radically inflating the M2 money supply. Combine this with an insane amount of base money being printed over at the Fed, and you have that explosion in the M2 money supply.

The Cat Is Out Of The Bag

Fun fact; Almost a fifth of all US money supply in existence was created in 10 months last year. Difficult to comprehend, right? In the entire 107-year history of the Fed printing money, all of that was printed in less than a year. That’s insane! And given that the vast majority of that is M2, it is effectively money printed out of thin air.

Sound far-fetched? Well, how about we hear it from the horse's mouth. Here is a snippet from the infamous 60 minutes interview with Neel Kashkari, the president of the Federal Reserve Bank of Minneapolis. This is what he had to say,

And they're not even trying to hide it. There is an unlimited amount of money that the Fed can print. They're flooding the system with money printed out of thin air. It looked as if he had a bit of an honest moment and spilled the beans.

Let’s listen to what Jay Powell, the chairman of the Federal Reserve system, had to say in his 60 Minutes interview,

So he openly admits to flooding the system with money, almost as if to say, “I can't keep this charade up anymore. You got me.” So now the lid’s been blown off this caper, the jig is up.

However, once free money and easy credit are out there, it's pretty hard to rein them back in, at least without some economic damage.

Also, leaving all that funny money in the system is risky because it can lead to some pretty crazy inflation levels. This is especially the case in a post covid world where an excess money supply is chasing limited goods.

For many of us, it’s becoming increasingly clear we really only use fiat money out of necessity. And some most definitely do not park it in a bank account because they know the bank will lend it out. So how do you secure your wealth these days?

Bitcoin, The Store Of Value Fiat Wishes It Was

An ever-increasing switched-on community suggests cryptocurrency. Bitcoin is the store of value that fiat wishes it was. There are so many reasons for this, starting with the most obvious of all. Bitcoin is limited in supply. There are only ever going to be 21 million Bitcoins mined. This is a protocol-defined limit that cannot be adjusted.

Bitcoin and prominent Altcoins are governed by code. There is no single individual or even a group of individuals that can change their limit. They also cannot change the rate at which cryptocurrency is mined.

In the case of Bitcoin, block rewards are also protocol-defined. 6.25 Bitcoin is mined per block every 10 minutes. This block reward number also decreases at every halving event. The most recent of which was May of 2020. There's no funny business going on here. It's just that simple.

Moreover, when you keep crypto in your own wallet, what you're effectively doing is becoming your own bank. You are the only person who can unlock your assets with your private key.

This is quite the opposite of the example mentioned earlier with money in the bank. The bank owns those funds, and the bank does whatever it wants to with that money. It even lends it out and inflates the money supply because, well, it can!

Another reason why many prefer cryptocurrency is that it is fully transparent and immutable. That means not only can we observe the actual state of the ledger, but no entity can reverse transactions or seize your coins.

Bitcoin is the granddaddy of the crypto industry, and arguably, there’s no other asset that's a better store of value out there. Although, some people may be asking, “what about gold? There was a gold standard for a reason.” Well, the Gold versus Bitcoin discussion is an entire topic in itself. Coin Bureau goes into detail in this video.

There is a growing community thrilled to be holding their wealth in Bitcoin and many other strong Altcoins. If anyone held fiat or gold post the covid crash, it would seem they would be in a far worse position than crypto enthusiasts are right now.

The only thing worse than the fiat money system is fractional reserve banking. The fiat system led to the creation of valueless money, and fractional reserve banking led to the uncontrolled expansion of it. What's even more concerning is that most people you speak to have no idea how money is made. All of these people use this money without having a clue as to how inherently unstable it is.

Not only that, but they store their savings in it. They keep money in bank accounts that don't have the funds to support it. All you need is one liquidity crunch to cause a panic: a panic, which can lead to a devastating bank run. If that doesn't show people how unstable fiat is, I don't know what will.

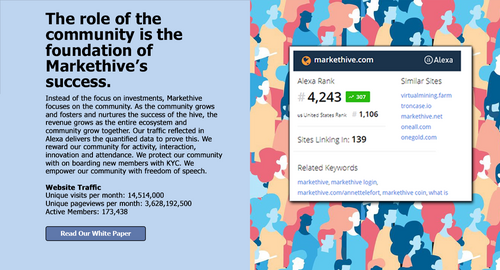

Steadfast Crypto Communities Delivering Economic Sovereignty Will Prevail

Actual savings requires holding money in a way that keeps pace with inflation, or even better – beats out inflation and cost of living. So there is salvation; it's the honey badger of money, the antifragile store of value that's limited in supply, censorship-resistant, and immutable.

Strong communities exponentially growing and committed to true liberty and economic independence will succeed in creating financial ecosystems withstanding the oppressive laws and executive orders that are deemed legal only because of the current powers that be say so. It is the most significant fraud that impacts the global population of all time.

The crypto industry has over ten years under its belt now. It is a thing, and with innovative technology rapidly increasing that will outsmart the antiquated oligarchal system. We’re beyond the hype. Cryptocurrencies are officially part of our global financial system with El Salvador being the first country to accept Bitcoin as legal tender.

David https://markethive.com/david-ogden